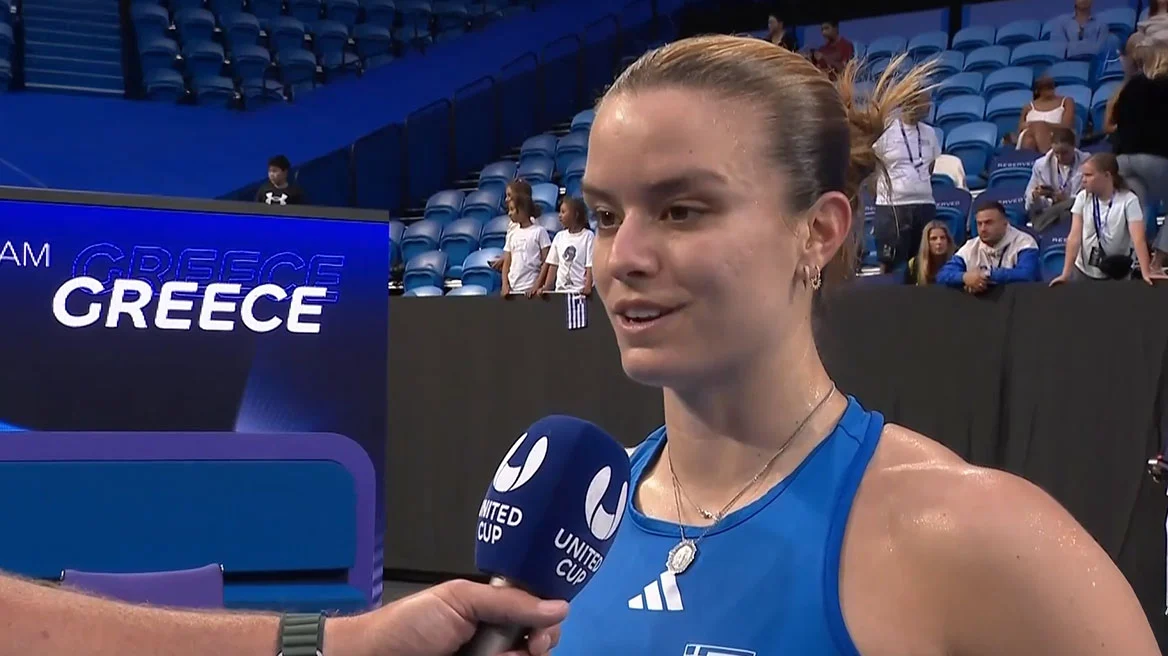

The European Central Bank should cut borrowing costs twice before the August summer holidays and twice more before the end of the year without being influenced by the Federal Reserve, according to ECB Governing Council member Yannis Stournaras.

“We need to start cutting interest rates soon so that our monetary policy doesn’t become too restrictive,” the Greek central banker said in an interview in London, Bloomberg notes.

“It is appropriate to make two rate cuts before the summer holidays and four moves during the year seem reasonable.

To that extent, I agree with market expectations.”

The ECB left policy unchanged last week for a fourth consecutive meeting, with officials converging around June as the right time to start easing, the agency comments.

They are now more confident that inflation is heading towards the 2% target, but are seeking further reassurances before deciding on rate cuts.

The Frankfurt-based central bank has scheduled monetary policy decisions for April 11, June 6 and July 18.

Thereafter, it will not meet again before 12 September.

Stournaras is among the so-called “doves” on the ECB’s board, although he recently aligned himself with members described as “hawks” on the need to wait until June.

“We will have little new information before the April meeting, especially on early 2024 wages – but we will have much more data before the June meeting,” Stournaras said, echoing comments made by ECB President Christine Lagarde last week.

“I think to cut interest rates already in April we would have to see the economy collapse and I don’t expect that.”

In the wake of the comments, money markets kept their bets on the range of borrowing cost cuts this year, with the first 25% move seen as a certainty by June, followed by two more with a 70% chance of a fourth.

Stournaras said that “economic growth in the euro area is much weaker than expected and risks are to the downside, while inflation has fallen significantly and risks are balanced”.

He also downplayed strong nominal wage increases, stressing that real wages will only reach pre-pandemic levels in 2025.

“So wages are still catching up, not ahead of inflation.

We should not exaggerate the risk of a wage-price spiral,” he said. All the more so as “nominal wage growth is moderating and earnings are absorbing some of the wage increases.”

Stressing the need to bring down borrowing costs soon, Stournaras referred to Bank of Greece estimates that “30% of the tightening of previous rate hikes is still in the pipeline”.

“On top of that, the ECB’s balance sheet will shrink by around €800 billion this year through the repayment of the TLTRO and the phasing out of APP and PEPP reinvestments,” he added. “Like interest rate hikes, this in itself leads to tighter financial conditions.”

Stournaras vehemently dismissed talk that it might be problematic or dangerous if the ECB eases monetary policy ahead of its US counterpart.

“I’m not at all convinced by the argument that we can’t cut rates before the Fed does – and almost all my colleagues agree with that,” he said.

Austria’s Robert Holzmann has repeatedly said he does not believe the ECB should move first – even after Lagarde insisted the ECB “will act independently” and others backed her.

“We are completely independent and the euro area is a large open economy with a flexible exchange rate,” Stournaras said.

“We have to do what is necessary for the eurozone economy – nothing else.”

The situation in the 20-nation region is “very different” from that in the United States, where the economy is growing, also thanks to an expansionary fiscal policy, and inflation is more persistent, he said.

“The case for lower interest rates is much more convincing for the euro area than for the US.”

Beyond 2024, he expects the deposit rate, currently at a record high of 4%, “to gradually decline to 2% at the end of 2025 or early 2026.”

He judges this to be a neutral level.

Kasselakis: Tsipras’ law on foreign companies is wrong – If necessary, I will pay the fine

“At the moment I don’t see interest rates falling below 2%, as was the case before the pandemic.”

With this week’s review of the ECB’s so-called operational framework, “we have taken the lessons of the last few years and made the ECB a more modern central bank,” he said.

He stressed that at the moment no one knows what the appropriate level of bank reserves and the ECB’s balance sheet is.

“In the end, the banks will tell us and they will determine how much liquidity they need,” he said.

“We will get to that point gradually, step by step, so as not to risk unintended turbulence.”

He expects the ECB’s balance sheet to be smaller than today but larger than in the past, saying “we will not reach that point in the next one to two years.”

A planned new structural bond portfolio “will help stabilize the economy,” he said.

The details still need to be discussed, “but the portfolio will include government bonds,” he said.

“We will make sure it will not violate the ban on monetary financing in the EU treaty.”

Ask me anything

Explore related questions