Bank of America’s latest positioning strategy for the EEMEA markets confirms that Greece has now moved into a different category for international portfolios and stands out as one of the most heavily overweight markets in the region, with steady inflows and high participation from active funds. Inflows into the region remained strong even after the correction in precious metals, as investors maintained a positive stance driven by expectations of a weaker dollar and favorable macroeconomic conditions.

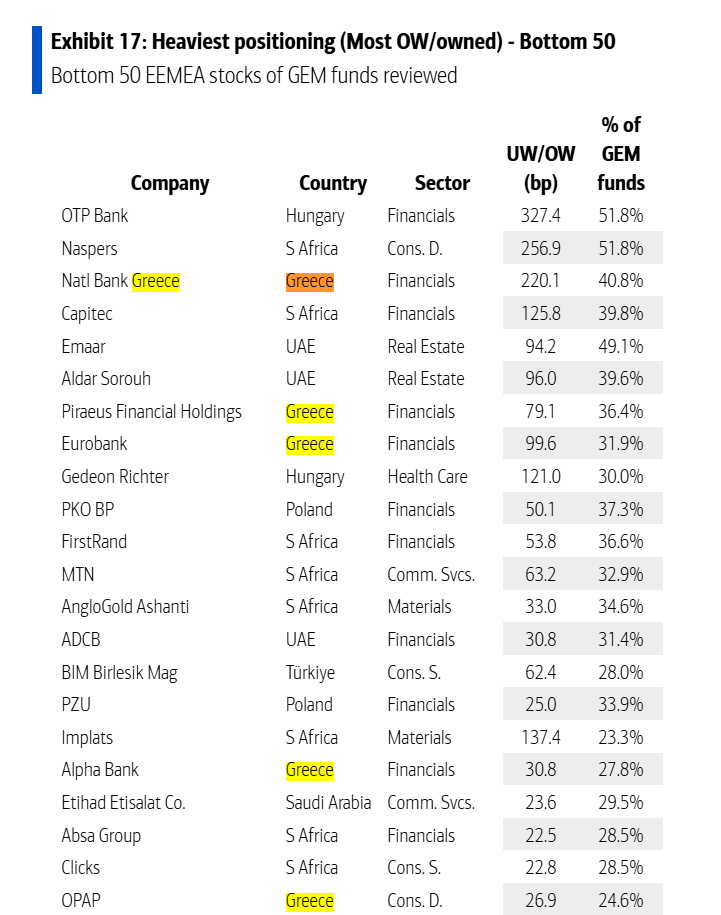

In terms of capital allocation, Greece appears as the most overweight market in the region, ahead of Hungary and Turkey. In practice, this means that international portfolios hold Greek equities well above their weighting in emerging market indices—an indication that the country is now viewed as a core investment exposure rather than a tactical allocation. Positions are concentrated mainly in banks and a handful of large blue chips such as National Bank of Greece, Eurobank, Piraeus Bank, Alpha Bank, OPAP, OTE, and Jumbo. The four systemic banks rank among the stocks with the highest participation by active funds in the region, highlighting that the Greek investment story is being played primarily through the profitability and capital returns of the banking sector.

Metlen and PPC are the next rotation

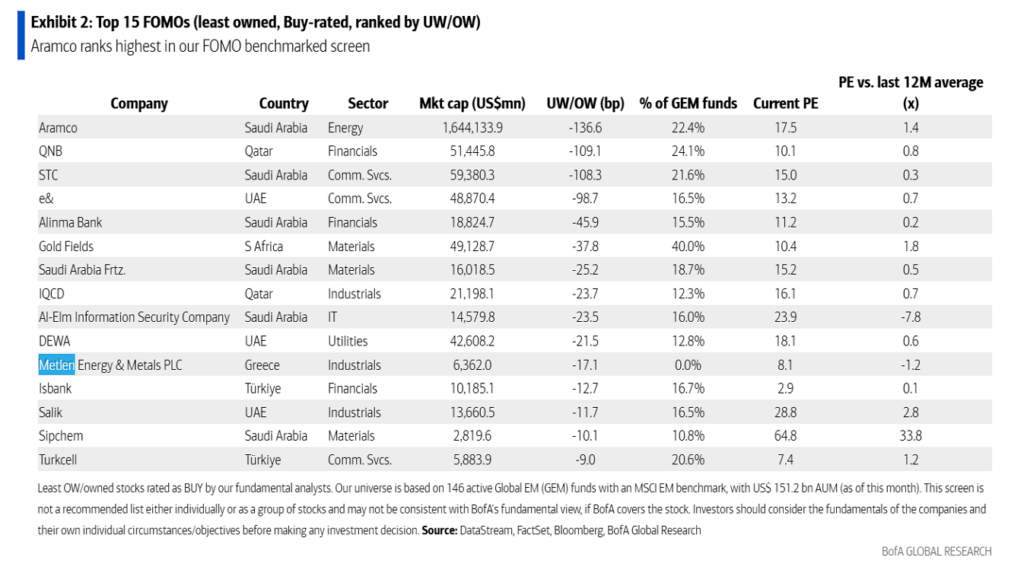

Beyond the “crowded” trades, there are also stocks where investors have not yet positioned themselves sufficiently. Metlen appears among the least-held stocks with a positive rating (fear of missing out – FOMO), meaning it is recommended but not yet widely present in fund portfolios.

Similarly, PPC (Public Power Corporation) shows lower participation relative to its importance in the index, suggesting potential room for increased positions as investors seek exposure to the energy transition and infrastructure. This point is critical, as historically the Greek market tends to move in two phases: banks are bought first, followed by energy and industry. Based on BofA data, Greece now appears to have entered the core of emerging markets for international funds. The main trade remains banks, while the next investment rotation could point toward Metlen and PPC.

Outlook for foreign markets and capital flows

Despite the correction in precious metals at the end of January, capital inflows into the EEMEA markets (Emerging Europe, the Middle East, and Africa) remain strong. During the period January 29 – February 4, some of the largest weekly inflows of the year were recorded across all markets in the region, without exception, confirming that investor interest in emerging markets (EM) remains robust.

Although such a strong wave of optimism could increase the likelihood of a short-term correction, BofA Global Research’s strategy remains positive for emerging markets overall, and especially for EEMEA equities in 2026. The key catalyst is the expectation of further weakening of the U.S. dollar, combined with a relatively favorable regional macroeconomic environment.

In terms of positioning, the consumer discretionary sector remains the main overweight in EEMEA, while utilities are the most underweight sector. Across emerging markets more broadly, technology maintains the strongest overweight positioning, while communication services show the largest underweights.

Cumulative flow data from 2014 to 2026 indicate that inflows into EEMEA debt (bonds) have consistently exceeded those into equities. The “gap” between bonds and equities stabilized from 2023, but in 2026 it has begun to widen again.

The flow data are sourced from EPFR’s “all bonds” and “all equity” categories and cover funds totaling USD 1.9 trillion in bonds and USD 4.2 trillion in equities. The analysis includes all EEMEA countries that participate in at least one of the GBI-EM, EMBI, or MSCI EM indices.

Ask me anything

Explore related questions